| Discover Algeria | About us | Press area | Contact |

E-commerce: Soon launch of a portal dedicated to web merchants

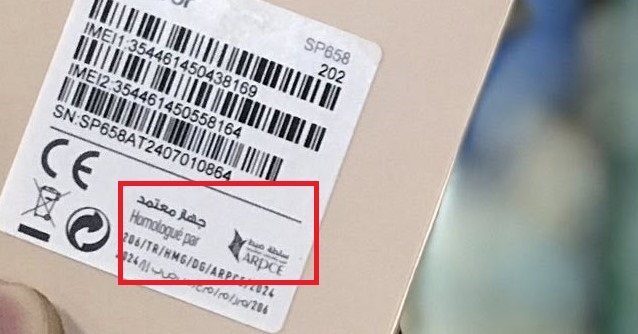

This portal is already "tested and finalized", said Mr. Messaoudène during a conference on "The new opportunities of digital transformation in the economy and finance", organized as part of the Information Technology Fair. and communication "ICT Maghreb".

All that remains is to put it online, which will be carried out "at the latest" in about ten days, "once certain administrative formalities have been completed", he added.

This portal will act as a "one-stop-shop" which will enable all stages of integration of an electronic payment platform, online "from application to certification", he explained, adding that this solution will save money. the web merchant to contact his banker, the Company for the automation of interbank transactions and electronic payment (SATIM) or Algeria Post.

The objective of this portal is, among other things, to "connect the developers of certified payment modules with merchants", underlined the director of GIE Monétique, adding that this portal will allow, in particular, web merchants who do not do not yet have a bank domiciliation to be canvassed by banks to domiciliate their commercial accounts.

In a second phase, this portal will integrate service providers such as logistics and transport platforms and even insurers who will be put in touch with e-merchants, mentioned Mr. Messaoudene, also evoking the "evolutionary" aspect. of this portal which "will refer to statistics and reporting" to "analyze the behavior of players throughout the ecosystem and make the necessary corrections".

Mr Messaoudene also announced the organization of a webinar after the launch of this portal in order to explain how it works and how accessible it is to all e-commerce players, including traders, banks, authorities. certification.

Speaking about the digital transformation in the banking and insurance sector, the head of GIE Monétique felt that FinTechs and start-ups must simplify the process in order to allow banks and insurers to expand their customer base. , welcoming in passing the introduction of the signature and electronic certification which he considered as a "great progress" which reinforces the security of the digital transformation.

Stock exchange: soon implementation of electronic listing

For his part, the Managing Director of the Stock Exchange Management Company (SGBV), Yazid Benmouhoub, considered that Fintech was one of the means to achieve "financial inclusion" and attract the money that circulates in the informal sector, qualifying it as a "keystone" capable of completely transforming the face of the Algerian financial sector.

In this sense, he indicated that the Fintech ecosystem is being set up with very innovative solutions developed by start-ups which are able to offer their products directly to international markets: in Africa. , in Europe or even in America.

Mr Benmouhoub, said that the Algiers Stock Exchange is working on the creation of a market dedicated to start-ups, calling for a change in the project financing model, based on bank loans to move towards new methods of raising funds. funds to meet the financing needs of companies that have been impacted by the financial and health crisis.

He also mentioned the establishment "very soon" of an information and electronic quotation system which will allow the Algiers Stock Exchange "to conform to the standards of other international stock exchanges".

For his part, the CEO of the insurance company Macirvie, Mohamed Hakim Soufi, noted that "the laws no longer meet the requirements of the moment" in the field of finance, recommending to allow start-ups to access regulated activities such as insurance and banking "which are the most important in terms of turnover", while putting them "under the authority of the State".

He called for "courageous" decisions to be taken in order to push customers to use electronic payment, by proposing, for example, "to lower the rate of VAT" for electronic transactions.